Metatrader 4 for Scalping: Quick Trading Strategies

Metatrader 4, or MT4, can be a well-known electrical investing foundation utilized by countless forex traders throughout the world. It is accessible for liberated to download and is also employed for investing economic instruments such as foreign currencies, shares, and products. The MT4 system could be custom-made, and traders can make use of different equipment and signs to assist them evaluate the trading markets. Within this extensive guideline, we will deal with all that you should know to perfect Metatrader 4.

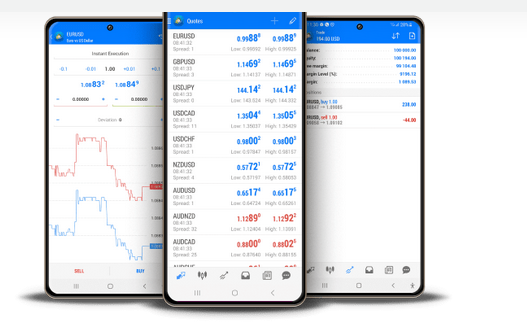

1. Knowing the MT4 User interface

The initial step to understanding MT4 is always to comprehend its graphical user interface. When you available the platform, you will notice different home windows and tabs. The “Industry Watch” windows displays the different fiscal equipment accessible for trading, while the “Navigator” windowpane shows your account information, signals, and professional experts. The “Terminal” windows screens your open deals and your business record. You may personalize these home windows by correct-hitting them and selecting “personalize.”

2. Including Personalized Indications

Signs are the most powerful equipment available for studying the market segments, and MT4 has a wide array of built in signs. Nevertheless, you may also add more your own personal customized signals. To do this, you have to download the signal rule and help save it towards the “Signs” folder in the MT4 directory site. Once you have done this, you can include the indicator for your graph or chart by simply clicking “Place” then picking “Indications.”

3. Employing Professional Experts

Professional Experts, or EAs, are automatic buying and selling solutions that may implement deals according to predetermined conditions. To make use of an EA, you need to download or produce a single. After you have carried this out, you can include the EA to the chart by simply clicking on “Navigator” then picking “Skilled Experts.” You can then establish the parameters for that EA, including the great deal sizing, cease-damage, and consider-profit ranges.

4. Backtesting Your Approach

Prior to starting investing with real money, it’s essential to backtest your method. MT4 enables you to try this using the “Method Tester” function. To utilize the Technique Tester, you need to select the specialist consultant you want to examination and then established the guidelines for the analyze. Upon having carried this out, you can start the exam and find out how your strategy will have executed previously.

5. Placing Investments and Managing Chance

Upon having backtested your approach and are ready to begin trading with real money, you should know how you can place investments and control danger. To place a industry, first you need to choose the fiscal tool you want to buy and sell after which click on “New Get.” You may then set the great deal size, cease-damage, and take-profit ranges. It’s necessary to deal with your risk by setting suitable stop-damage amounts instead of risking greater than within your budget to get rid of.

Conclusion:

In conclusion, understanding Metatrader 4 demands knowing its user interface, incorporating personalized signs, employing skilled analysts, backtesting your technique, and putting trades when managing risk. By simply following the guidelines within this comprehensive information, you are able to develop into a successful MT4 investor. Always training great danger managing and also to have patience, as learning MT4 usually takes time and energy. With devotion and persistence, you are able to accomplish good results with Metatrader 4. Pleased buying and selling!